Digital Sales Benchmarks

Personal Loan Journey Analysis

Executive Summary

For customers applying for a personal loan, the process should feel simple, transparent, and supportive. Today the journey often feels long and repetitive, with unclear eligibility and excess data entry. Guided by NAB's focus on customer obsession, this review compares NAB's experience with peers and sets out a redesigned three step journey that saves time, builds trust, and makes it easier for customers to move from exploring options to completing their application.

Projected Impact of Recommendations

1. Methodology

This analysis combines first-hand experience and external data. I personally applied for personal loans at NAB, CBA, and Westpac to observe the end-to-end customer journey. Each stage was documented with screenshots that highlight friction points and best practices. These walkthroughs form the core evidence base. To complement this, I analysed digital traffic and keyword performance using Semrush, which provided insights into visibility gaps and funnel strength versus peers. Building on these inputs, the study proposes a revised user journey for NAB's application form and a keyword strategy to strengthen Explore-stage discoverability. Together, these sources and recommendations ground the analysis in both observed experience and quantitative performance, and translate into actionable improvements.

Evaluation Criteria

- • Understand end-to-end customer experience

- • Personalisation

- • Time to apply

- • Ease of Information

- • Features of tools and calculators

- • Levers that drive top of funnel sales

Data Sources

- • Direct user journey testing

- • Semrush website analytics

2. Search and Funnel Discovery

Organic vs Paid Snapshot

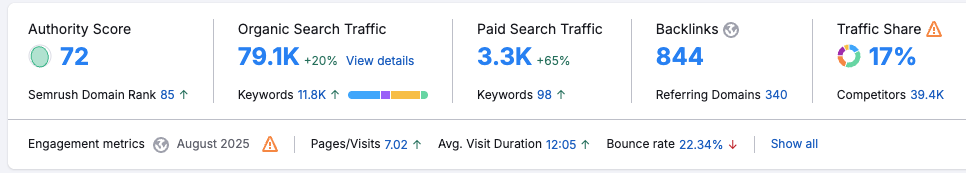

NAB's overall domain performance and traffic distribution

Keyword intent distribution of Organic traffic

Search behavior patterns by intent

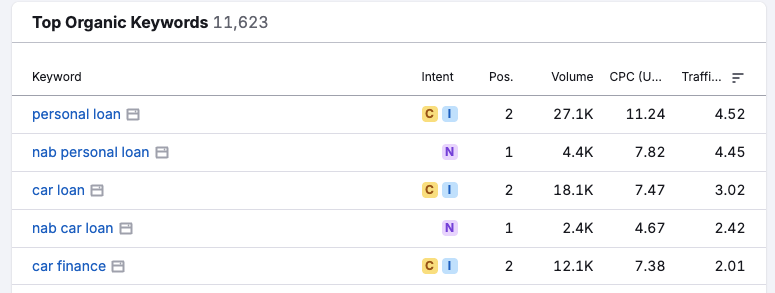

Top performing organic keywords with search intent indicators

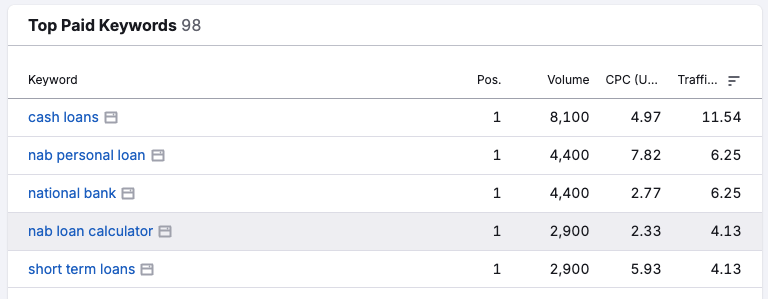

Top paid keywords and their cost-per-click performance

Source: Semrush analytics on https://www.nab.com.au/personal/personal-loans

Key Insights

- • NAB dominates branded search terms but lags in high intent generic queries like "personal loan calculator" and "personal loan rates."

- • Organic keyword universe is growing but NAB's traffic share is not, meaning competitors are capturing more of the growth.

- • Opportunity: Build content and tools strategy to win explore stage discoverability.

3. Cross-Bank Analysis

Findings from Explore Stage

| Bank | Strengths | Weaknesses | Opportunities |

|---|---|---|---|

NAB NAB | Clear loan calculator, competitive rates display | Generic content, limited personalisation, Information overload, No anchor or summary of content | CTA and summary of all action points in the header section |

CBA CBA | Strong brand trust, comprehensive FAQ, repayment slider | Complex navigation, information overload | Option to apply on website |

Westpac Westpac | Clean interface, good mobile responsiveness | Limited rate transparency, basic calculator | Simplify text |

Application Form Analysis

| Bank | Strengths | Weaknesses | Opportunities |

|---|---|---|---|

NAB NAB | Progress indicator, clear field labels | 30+ minute completion time, no save/resume | ID verification, automated prefilling |

CBA CBA | Document upload, real-time validation | Only mobile app option, KYC validation fails after multiple attempts | KYC validation ease |

Westpac Westpac | Simplified layout, fewest clicks and data entry points | Repetitive data entry | Integration with existing customer data |

4. Cross-Bank Themes

Common Pain Points

- Lengthy application processes averaging 12+ minutes

- Poor mobile experience across all platforms

- Lack of progress saving and application retrieval

- Inconsistent error messaging and validation

Emerging Opportunities

- ID verification and automated data prefilling

- AI-powered application assistance

- Real-time eligibility assessment

- Personalized rate and product recommendations

5. Key Recommendations

Customer Experience

- • Simplify the personal loan journey into fewer, clearer steps that reduce friction for customers and highlight eligibility upfront.

- • Provide transparency and reassurance at every stage of the journey to reinforce NAB's commitment to customer obsession.

Key metrics to monitor: Application completion rate, average time to complete, customer effort score.

Funnel Optimisation

- • Improve the Explore to Apply handoff by making tools and calculators seamlessly lead into the application flow.

- • Build a structured experimentation framework (hypothesis → test → learn → scale) to continuously improve conversion.

Key metrics to monitor: Calculator to Apply clickthrough, Apply start rate, Apply abandonment rate.

Market Visibility

- • Strengthen organic presence in non-branded high-intent queries by building optimised content and tools that capture customers earlier in the funnel.

- • Use data-driven insights from search analytics to prioritise areas where NAB lags peers and measure share gains over time.

Key metrics to monitor: Share of non-branded keyword clicks, traffic from Explore pages, ranking position for high-value loan terms.

Keyword Strategy

| Intent | Example keywords | Asset to build | Success metric |

|---|---|---|---|

| Top of funnel | personal loans Australia, compare loans | Comparison hub + FAQ schema | CTR from search and time on page |

| Mid funnel | personal loan calculator, borrowing power | Interactive calculators with sticky CTA | Calculator → Apply clickthrough |

| Purpose led | debt consolidation loan, car loan | Purpose pages with tailored defaults | Apply starts per purpose page |

| Rate seekers | personal loan rates, fixed loan rates | Rate hub with personalised teaser | Clicks on Check my rate |

| Experience led | loan documents checklist, approval time | Quick guides with reassurance copy | Scroll depth and Apply starts |

6. Revised Web Page for NAB (Explore + Apply)

Key Design Principles

- • ID Verification First: Streamline data entry through automated prefilling

- • Progressive Disclosure: Show only relevant fields at each step

- • Mobile-First Design: Optimized for smartphone completion

- • Real-Time Validation: Immediate feedback and error prevention

- • Trust & Security: Clear privacy indicators and secure processing

Interactive Prototype

Step 1: Personal Details & ID Verification

Drag and drop your ID, or click to browse

Conclusion

The analysis reveals significant opportunities for NAB to differentiate itself in the personal loan digital experience. By implementing the recommended changes, particularly the ID verification and automated prefilling system, NAB can transform its current market position.

Projected Impact of Recommendations

The proposed solution positions NAB as an innovation leader in the Australian banking sector, potentially capturing market share from competitors while significantly improving customer satisfaction and operational efficiency.